Recognize opportunities and turn them into successes.

Creative, professional, based on partnership

AP Capital is an entrepreneurial family office that focuses on real estate and has specialized in corporate investments. Founded and managed by Arthur Reiter and Pirmin Gellner, our dynamic, highly qualified management team creates sustainable and growing values.

Our goal: Responsible and profitable investments with a long-term investment horizon - from existing capital and as a strong operating partner for private equity companies and institutional investors.

Our track record: success in numbers.

Founded in 2011

+450 employees in 12 holdings

+7.2 billion assets under management

Approximately 100,000 sqm of residential property owned

14 investment professionals on the team

+400 million euro transaction volume

Real Estate

Our real estate expertise: Deep market knowledge meets active management.

We are experts in real estate repositioning, combining strategic thinking with proactive action - nationwide. Thanks to our local market knowledge, we reduce vacancies and increase long-term property values. We invest counter-cyclically, are closely networked with all stakeholders and implement targeted measures for success. Through our associated property management, we cover the essential services of the value chain. Our holding company invests together with partners, such as institutional investors and private equity firms, in order to successfully exploit the opportunities of the market.

- Focus: Investments in residential and commercial properties with cash flow

- Services: Turnaround of assets and portfolios, lease management, identification and realization of potential, analysis and implementation of ESG measures

- Networking: With all relevant market participants (building planning offices, architects, executing companies, real estate agents, etc.)

Our team for real estate investment & asset management.

Arthur Reiter

Founding Partner

BA in International Management and certified real estate economist (Franklin University in Lugano & IREBS Regensburg). 18+ years of experience in real estate investment firms (Morgan Stanley Argoneo, SEB) - entrepreneur since 2014.

Pirmin Gellner

Founding Partner

BSc and MSc in Management (EBS Oestrich-Winkel, Sorbonne Université in Paris, Concordia University in Montreal). 10+ years of experience in a renowned management consulting firm (Oliver Wyman) - entrepreneur since 2019.

Christian Lehn

Managing Partner, CFO

BSc in Management & Business Law and MSc in International Accounting & Finance (EBS Oestrich-Winkel, Cass Business School in London) Real estate economist (IREBS), 17+ years of experience in M&A and investment firms (Citi, KPMG, FREO).

André Weitkamp

Head of Investment

MRICS, Diploma in Business Administration in Real Estate Management (BA), Diploma in Expert (DIA), 26+ years in the real estate industry, including Morgan Stanley Argoneo, Deka Immobilien, Apleona, Principal Real Estate.

Corporate investments

Our strategic approach: diverse, effective, long term.

As a family office with a long-term investment horizon, we invest in companies in a wide range of industries - and in their future. With our experienced team, we individually drive the further development as well as the organic and inorganic growth of each company.

We implement new structures and processes and professionalize management. This is how functioning business models are created: in harmony with existing teams, perfectly positioned for tomorrow and of lasting value.

Our portfolio: Positioned across industries.

Real estate

Service company for services in the areas of energy, administration, insurance (>4 million sqm under management, >150,000 residential units)

Investment

Real estate asset and investment management company with currently 7.2 billion euro in assets under management (>85,000 units, >4.5 million sqm of space)

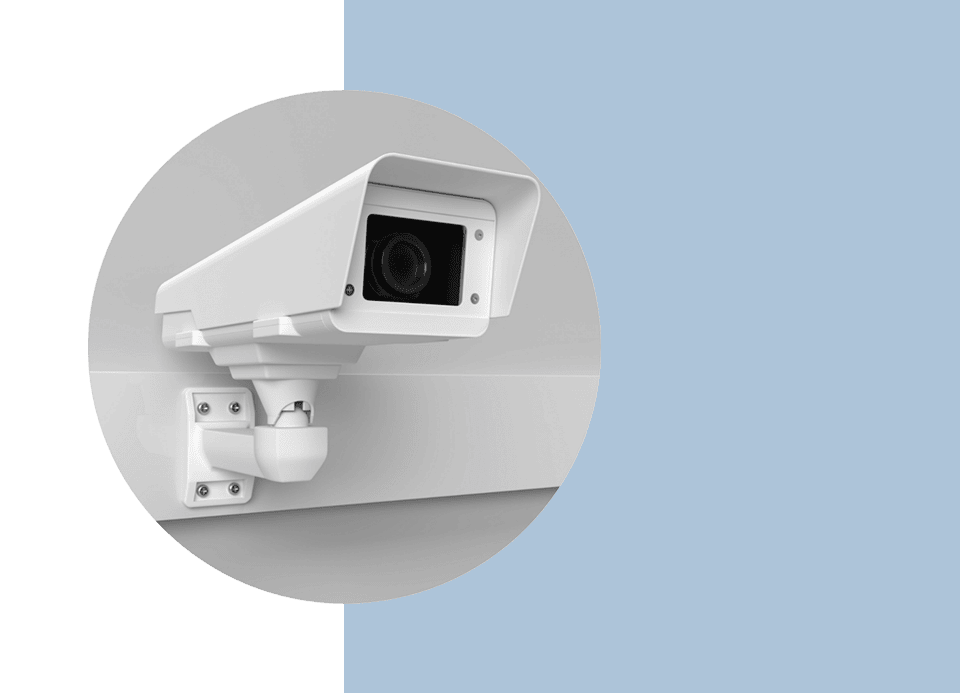

Security technology

Europe-wide operating company for early fire detection and alarm systems (>2,000 customers, >700 crimes prevented per year, >500 fire sources detected per year)

IT & Software Development

Established company and partner of DAX companies for automation and scalable software and system solutions (>900 customers, >24,000 projects)

Lifestyle

Premium fitness center with day spa and hotel, training facility for the basketball first division team Niners Chemnitz (>2,500 memberships, >17,500 sqm of usable space)

Wood industry

Minority stake in a wood-processing business including its own pellet plant (55,000 tons of pellets, 150,000 cubic meters of softwood cutting per year)

Our team for corporate participation.

Lucas Wagner

Managing Partner

BSc in Business Administration and MSc in Management (University of Mannheim, Cardiff University) 3+ years of experience in a renowned management consulting firm (Oliver Wyman) - entrepreneur since 2019.

Christian Lehn

Managing Partner, CFO

BSc in Management & Business Law and MSc in International Accounting & Finance (EBS Oestrich-Winkel, Cass Business School in London) Real estate economist (IREBS), 17+ years of experience in M&A and investment firms (Citi, KPMG, FREO).

"Our strength is recognizing future potential early on and developing it sustainably. We always question the status quo, and recognize and use all opportunities - with ingenuity and experience."

Arthur Reiter & Pirmin Gellner

Values

Our Values: Responsible investment.

Personally committed, mutually beneficial: With this mindset, we make our investments. Whether it is about our business capital or that of our partners.

Ambition

We set our goals high and achieve them - through discipline in implementation, agility and cooperation.

Integrity

We stand by our word and follow up on our actions - responsibly, promptly and with a sense of social responsibility.

Pragmatism

We act transparently - our thinking and actions are focused, professional and always comprehensible.

Our search profiles

Focused on growth.

We are always interested in offers to expand our portfolio - especially from the following areas:

Residential properties

Individual assets

- Individual assets from 3 million euro

- Generating long-term cash flow (no need for complete renovation, <10% commercial)

Portfolios

- From 10 million eur

- Non-performing loans (from 2,000 residential units nationwide, >100 million euro transaction volume)

- Key regions: Berlin, Saxony, Thuringia, Saxony-Anhalt

Commercial real estate

The development of a nationwide specialist retail portfolio is our focus in the commercial real estate sector. In particular, we are interested in neighborhood centers and local supply locations with a diversified tenant structure in urban areas with 10,000 inhabitants or more.

- Individual assets retail market: 8-15 million euro

- Portfolio retail market: 4-6 properties, from 40 million euro

- Smaller specialty stores up to larger retail complexes

- Good transport links, visibility and sufficiently large local clientele

- Asset classes: Core Plus to Value Add to Opportunistic

- WALT between 2-5 years

Corporate holdings

- Owner-operated companies in the DACH region

- Mainly majority, partly also minority holdings

- Minimum turnover: 5 million euro per year

- Smaller bolt-ons in existing business areas or regions possible

- Focus: Investments in sustainable, promising business models